jefferson parish property tax rate

The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560. Online Property Tax System.

Louisiana Property Tax Calculator Smartasset

Jefferson Parish is pleased to announce the opening of its 2022 First-Time Homebuyer Assistance Program.

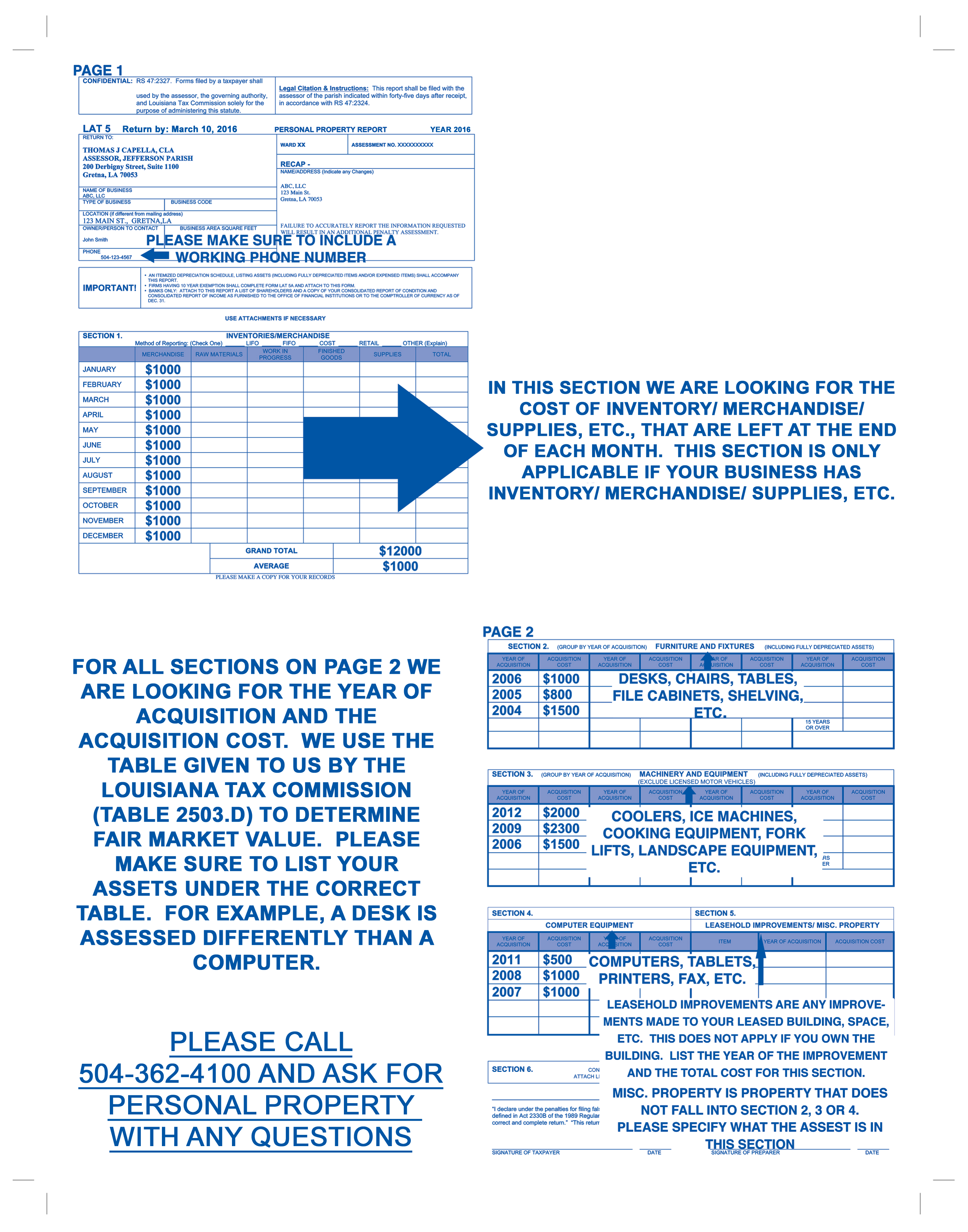

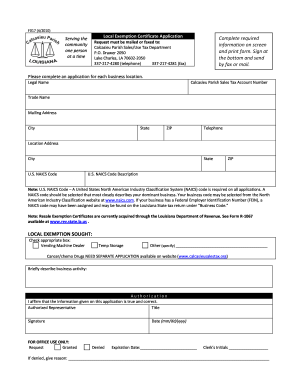

. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county. Utilize our e-services to. Property taxes are levied by millage or tax rates.

La Salle Parish -1 Tax Assessor. Whether you are already a resident or just considering moving to Jefferson Davis Parish to live or invest in real estate estimate local. Learn all about Jefferson Davis Parish real estate tax.

Jefferson Davis Parish -1 Tax Assessor. Our office is open for business from 830 am. Please contact the Jefferson Parish Sheriff 504-363-5710.

With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

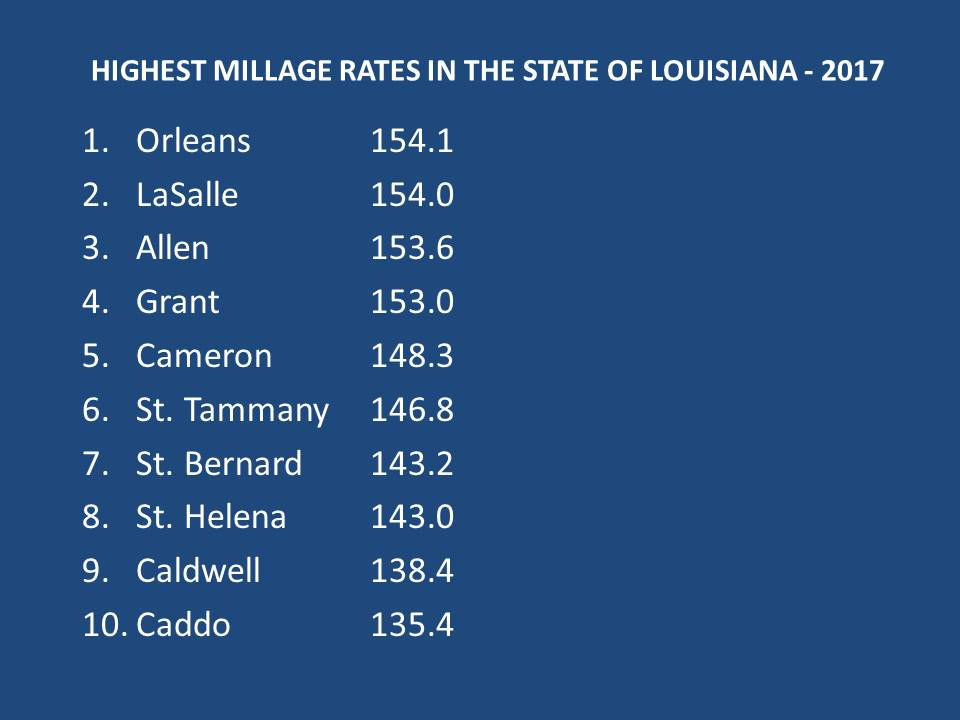

Most millage rates are approved when voted upon by voters of Jefferson Parish. Jefferson Davis Parish collects on average -1 of a propertys. If a Homestead Exemption HEX.

This rate is based on a median home value of 180500 and a. Jefferson Parish Sheriffs Office. What is the sales tax rate in Jefferson Parish.

Whether you are presently. Lafayette Parish 583 Tax Assessor. 1233 Westbank Expressway Harvey LA 70058.

The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of. Jefferson Parish Wards. CLICK MORE for information about the program and how to participate.

For comparison the median home value in Jefferson Parish is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street.

Jefferson Parish collects on average 043 of a propertys. Due to the Annual Tax Sale this site can only be used to view andor order a tax research certificate. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10.

The preliminary roll is subject to. Lafourche Parish 390 Tax Assessor. Administration Mon-Fri 800 am-400 pm Phone.

A mill is defined as one-tenth of one cent. Only open from December 1 2021 - January 31 2022. This gives you the assessment on the parcel.

Jefferson Parish Sheriffs Office. This is the total of state and parish sales tax rates. 2021 Plantation Estates Fee 50000.

You may call or visit at one of our locations listed below. The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. Jefferson Parish 755 Tax Assessor.

Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052.

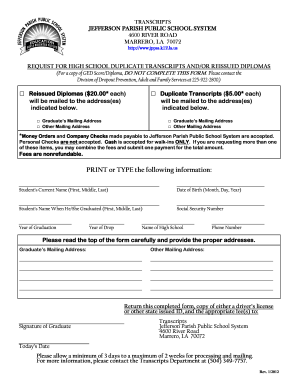

Cities Towns Jefferson Parish Sheriff La Official Website

Get And Sign Calcasieu Parish Sales Tax Form 2010 2022

More Details On Lincoln Schools Opening Property Tax Rates Adopted Lincoln Parish News Online

Louisiana Property Taxes Taxproper

Jefferson Parish Assessor S Office Millages Wards

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans Archive Nola Com

Jefferson Parish Wifi Password Fill Out And Sign Printable Pdf Template Signnow

Property Tax Overview Jefferson Parish Sheriff La Official Website

How Healthy Is Jefferson Parish Louisiana Us News Healthiest Communities

Home Loans Jefferson Parish Employees Fcu

Jefferson Parish Finance Authority Facebook

Jefferson Parish Louisiana Home

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZKHDMBZNGRHEZGFLMI6NSFPPOU.jpg)

Will Jefferson Parish Increase Property Taxes By Collecting 100 Percent Of The Drainage Tax

About Assessors Louisiana Assessors Office

.jpg?width=736&name=COVID-19-Map%20(9).jpg)